1. RBI’s 25-Basis-Point Repo Rate Cut: A Strategic Shift Toward Growth

The Reserve Bank of India’s recent decision to reduce the repo rate by 25 basis points, bringing it down to 5.25%, marks one of the most significant monetary moves since 2019. This shift signals the central bank’s strong intention to support economic recovery amid an uncertain global environment characterized by fragile international demand, trade disruptions, and geopolitical tensions. The rate cut is meant to lower borrowing costs across the financial system, encouraging businesses to invest more and consumers to spend. As the cost of credit declines, banks are expected to pass on the reduced rates to borrowers, stimulating the credit cycle. The move is particularly important at a time when private sector investment has been sluggish.

The RBI’s decision also aligns with moderating domestic inflation, which has given policymakers greater flexibility to adopt a more accommodative monetary stance. Inflation has cooled due to stable food prices, efficient supply chains, and declining global commodity rates. Lower inflation creates space for monetary easing without risking price instability. The central bank’s focus is now on boosting consumption, supporting job creation, and giving momentum to sectors such as infrastructure, manufacturing, and real estate. Analysts believe the rate cut reflects an attempt to create a “Goldilocks economy”—where inflation is contained and growth accelerates without overheating.

However, risks remain. Further easing could weaken the rupee, raise import costs, and potentially re-ignite inflation. Yet overall, the rate cut demonstrates the RBI’s confidence that the Indian economy can handle short-term risks in return for long-term growth benefits.

2. RBI’s Liquidity Injection Through Open Market Operations

Alongside the rate cut, the RBI’s decision to conduct large-scale open market operations (OMOs) represents a powerful injection of liquidity into the financial system. OMOs are a critical tool for managing liquidity, ensuring banks have sufficient funds to lend and preventing liquidity shortages, especially during times of market volatility. By purchasing government securities from banks, the RBI effectively infuses cash into the system, boosting credit availability and stabilizing the banking sector.

Thank you for reading this post, don't forget to subscribe!This strategy comes at a time when global financial markets are experiencing heightened volatility due to geopolitical tensions, energy price fluctuations, and tightening monetary policies in advanced economies. Increased liquidity helps Indian banks manage their balance sheets, supports the lending cycle, and prevents financial stress among borrowers. It also stabilizes the bond market by preventing sharp rises in yields, ensuring government borrowing costs remain manageable.

The liquidity boost is also intended to support India’s infrastructure expansion, manufacturing push, and digital economy initiatives. It helps corporate borrowers refinance debt at lower costs and encourages sectors like MSMEs, which often struggle with cash flow issues.

However, there are medium-term risks. Too much liquidity can create asset bubbles—especially in real estate and equities—if not managed carefully. The RBI will need to balance liquidity expansion with inflation management. Nonetheless, OMOs remain an essential part of the central bank’s toolkit for stabilizing financial conditions and supporting growth momentum in India.

3. RBI’s $5 Billion Forex Swap: Rupee Stabilization & FX Reserve Management

The RBI’s announcement of a $5 billion foreign exchange swap arrangement is a strategic intervention aimed at stabilizing the rupee and strengthening foreign exchange reserves. The move adds dollar liquidity to the system while simultaneously providing the central bank with additional tools to manage currency volatility. India has been facing periodic depreciation pressures due to global risk aversion, tightening U.S. monetary policies, and elevated crude oil prices. In such an environment, maintaining strong FX reserves is essential for market confidence.

The swap deal boosts India’s reserve buffer, thereby enhancing its ability to handle external shocks such as sudden capital outflows or rising import costs. A more stable rupee also helps businesses that rely heavily on imported goods, particularly India’s massive energy and technology sectors. Additionally, the swap strengthens the RBI’s ability to intervene in currency markets when necessary, without directly depleting reserves.

Financial markets generally view such measures as a sign of policy discipline and preparedness. It signals to global investors that India is committed to maintaining currency stability and avoiding sharp depreciation episodes. However, this strategy also has limitations—frequent FX interventions can drain resources and distort natural market pricing. Despite potential drawbacks, the forex swap demonstrates India’s proactive approach to shielding the economy from external volatility while creating a conducive environment for investment and trade growth.

4. India’s “Goldilocks Scenario”: Moderate Inflation + Rising Growth

India is currently positioned in a desirable macroeconomic zone often referred to as a “Goldilocks scenario”—where growth remains strong while inflation is moderate. This balance is critical for long-term economic stability. Moderate inflation provides predictable conditions for businesses, while strong growth supports employment, consumption, and private investment. The RBI’s recent policy easing seeks to maintain this delicate balance.

Several factors have contributed to the current environment. First, food inflation has stabilized due to robust agricultural output and stronger supply chains. Second, the global easing of commodity prices, especially metals and food grains, has reduced input costs for businesses. Third, domestic structural reforms—digital payments, GST efficiency, and logistics improvements—have improved productivity.

Under a Goldilocks environment, both consumers and producers enjoy confidence. Consumers have more purchasing power, and producers are more willing to invest thanks to lower financing costs and stable demand conditions. This environment also attracts foreign investment, as investors prefer markets with predictable inflation and strong growth outlooks.

However, this scenario remains fragile. Rising global energy prices, geopolitical tensions, and supply-chain disruptions could quickly destabilize inflation. Furthermore, excessive monetary easing could risk inflationary spillovers in the long term. Therefore, while India currently enjoys a favorable macroeconomic backdrop, sustaining it will require prudent policymaking and careful monitoring of global and domestic risks.

5. Risks of Excessive Monetary Easing: Currency Depreciation & Inflation

While the RBI’s accommodative stance offers growth benefits, it also introduces risks—chief among them being currency depreciation and rising inflation. When interest rates drop and liquidity increases, the currency tends to weaken because lower yields make Indian assets less attractive to foreign investors. A weaker rupee increases the cost of imports, especially crude oil, which can directly influence inflation.

India imports more than 80% of its crude oil, meaning even slight currency depreciation has major fiscal implications. Higher oil prices could trickle down to transport, manufacturing, and consumer goods, reversing the current moderation in inflation. Additionally, lower interest rates could lead to excess credit expansion, generating asset bubbles in real estate and stock markets. These bubbles can become sources of instability if they burst suddenly.

There is also the challenge of managing external balances. Easier monetary policy may lead to higher demand for imports, widening the current account deficit. At the same time, global investors may pull out funds in search of higher yields elsewhere, putting further pressure on the rupee.

Despite these risks, the RBI believes the current macroeconomic environment provides enough flexibility to manage potential spillovers. The central bank is prepared to adjust its policies if inflation rises or if currency volatility becomes excessive. Nonetheless, the trade-off between growth and stability remains central to India’s monetary policy strategy.

6. Market Reactions: Bond Yields, Equity Markets & Rupee Movement

The immediate market reaction to the RBI’s policy announcements has been mixed but generally positive. Bond yields declined slightly, reflecting expectations of lower interest rates and improved liquidity conditions. Lower yields benefit the government by reducing borrowing costs, while corporate sectors also find refinancing more affordable. Equity markets responded with cautious optimism, posting modest gains as investors welcomed the pro-growth stance.

Financial stocks performed particularly well, as banks benefit from increased liquidity and stronger credit demand. Infrastructure and real estate stocks also saw gains because lower interest rates typically translate into higher investment and property purchases. However, some sectors—especially export-driven industries—expressed concern about the rupee’s slight depreciation following the announcement.

The rupee weakened modestly against the U.S. dollar, reflecting concerns about external pressures and potential capital outflows. However, the forex swap announcement limited deeper depreciation. The RBI’s combination of rate cuts, OMOs, and FX measures reassured market participants that the central bank would maintain financial stability.

Overall, markets viewed the policy package as balanced—supportive of growth without signaling excessive risk-taking. While investors remain watchful of global developments, the policy announcement reinforced confidence in the Indian economy’s resilience and policy credibility.

7. India–Russia Geopolitical Realignment & $100 Billion Trade Target

Russia’s recent engagement with India, highlighted by President Vladimir Putin’s visit, reflects a significant shift in geopolitical and economic priorities. Both nations are working to elevate bilateral trade to $100 billion by 2030, a target that underscores a strategic push to diversify supply chains and reduce dependence on Western markets. India is seeking to strengthen partnerships in sectors such as defense, energy, nuclear cooperation, and technology.

Russia is emerging as a major supplier of crude oil to India at discounted rates. This shift not only provides India with cost-effective energy but also reduces vulnerability to fluctuations in Middle Eastern supply chains. Furthermore, India and Russia are exploring settlements in local currencies to safeguard trade from Western sanctions and reduce exposure to dollar volatility.

Defense cooperation remains a cornerstone of the relationship, with joint production, technology transfers, and new procurement agreements under discussion. Additionally, India is keen to expand collaboration in renewable energy, nuclear reactors, space technology, and advanced weaponry.

However, this geopolitical alignment comes with diplomatic challenges. India must balance its ties with Russia while maintaining strong relations with Western allies, especially the U.S. and EU. Strengthening economic ties with Russia could invite scrutiny from Western nations monitoring compliance with global sanctions. Thus, India’s diplomatic strategy must remain carefully calibrated to preserve strategic autonomy.

8. Federal Reserve’s Expected Rate Cut & Global Market Sentiment

Markets worldwide are anticipating a 25-basis-point interest rate cut by the U.S. Federal Reserve at the December 9–10 FOMC meeting. The expectation stems from easing inflationary pressures and signs of a cooling labor market. As a result, the U.S. dollar has weakened to multi-week lows, creating volatility across global currency markets.

A Fed rate cut has broad implications for global capital flows. Lower U.S. rates reduce the attractiveness of dollar-denominated assets, prompting global investors to shift funds toward emerging markets offering higher yields. This capital inflow could benefit countries like India, Indonesia, Brazil, and South Africa, boosting their equity and bond markets.

However, risks remain. A premature rate cut could weaken the Fed’s inflation fight, especially if core inflation remains above target. Some policymakers within the Fed are skeptical about easing too soon, warning that it could lead to inflation rebound risks similar to the 1970s.

The rate cut could also influence commodity prices. A weaker dollar usually supports commodities such as gold, crude oil, and industrial metals. For energy-importing countries like India, this could slightly elevate import bills.

Overall, the global financial system is entering a phase of heightened sensitivity to U.S. monetary policy signals, with markets adjusting strategies in real time based on inflation, employment, and GDP data trends.

9. Impact of U.S. Policy Easing on Emerging Markets

If the Federal Reserve proceeds with its anticipated rate cut, emerging markets stand to gain from improved capital flows, cheaper borrowing costs, and increased investor appetite. Lower U.S. yields reduce global dollar financing costs, making it more affordable for developing countries to issue bonds, service existing debt, and finance infrastructure projects.

For countries with high dollar exposure—such as Sri Lanka, Pakistan, Egypt, and several African economies—a weaker dollar provides immediate relief by lowering the cost of external debt repayments. Additionally, emerging market currencies typically strengthen in such environments, reducing imported inflation.

India could witness increased foreign investment inflows into equity and debt markets. This would support financial stability, strengthen the rupee, and deepen liquidity. However, emerging markets must also navigate volatility risks. If inflation data in the U.S. surprises on the upside, the Fed may reverse course, triggering sudden capital outflows and market turmoil.

Thus, while emerging markets could benefit from U.S. monetary easing, the situation requires careful monitoring and strategies to absorb potential shocks. Countries with strong fundamentals—like India—are better positioned to capitalize on the opportunities while managing risks from global financial shifts.

10. Ukraine–Russia–U.S. Diplomacy: A Fragile Negotiation Path

Diplomacy surrounding the Ukraine–Russia conflict remains highly complex, with U.S. envoys engaging Moscow in discussions aimed at exploring potential peace frameworks. Russia insists on recognition of its territorial claims, especially concerning Donbas, while Ukraine remains firm on protecting its sovereignty. These opposing positions create deep obstacles for negotiations.

European countries fear that direct U.S.–Russia dialogue could sideline European interests and force a ceasefire that freezes the conflict without resolving critical issues. Many European leaders worry that such an agreement could weaken Ukraine’s security while strengthening Russia’s geopolitical influence.

Ukraine itself is divided internally. Some leaders favor exploring ceasefire terms to alleviate the economic and humanitarian crisis. Others argue that any ceasefire without territorial restoration undermines national integrity and rewards aggression.

Financially, Ukraine is under severe strain, relying heavily on aid for military and reconstruction efforts. Without a stable and predictable aid package, Ukraine risks deeper economic collapse.

Overall, the diplomatic situation remains fragile and fluid. A sustainable peace agreement requires balancing strategic interests of Kyiv, Moscow, Washington, and Europe—making any breakthrough difficult and time-consuming.

11. Israel’s $34 Billion Defense Budget for 2026

Israel’s decision to allocate 112 billion shekels (approximately $34 billion) for the 2026 defense budget reflects escalating regional threats and the need to prepare for potential multi-front conflicts. The budget prioritizes modernization of military equipment, replenishing depleted stockpiles, and strengthening reserve forces.

Israel faces ongoing challenges, including tensions with Hamas in Gaza, Hezbollah in southern Lebanon, and broader regional instability involving Iran-backed militias. The increased budget also aims to enhance intelligence capabilities, missile defense systems, cyber security units, and border security technologies.

Domestically, the budget has sparked debate, with critics arguing that resources should also be allocated toward reconstruction, social welfare, and humanitarian support, especially in Gaza. Supporters argue that security threats must take precedence.

Economically, the defense expansion could strain Israel’s fiscal health unless supported by reforms or international assistance. It could also influence regional military strategies, potentially intensifying the arms race.

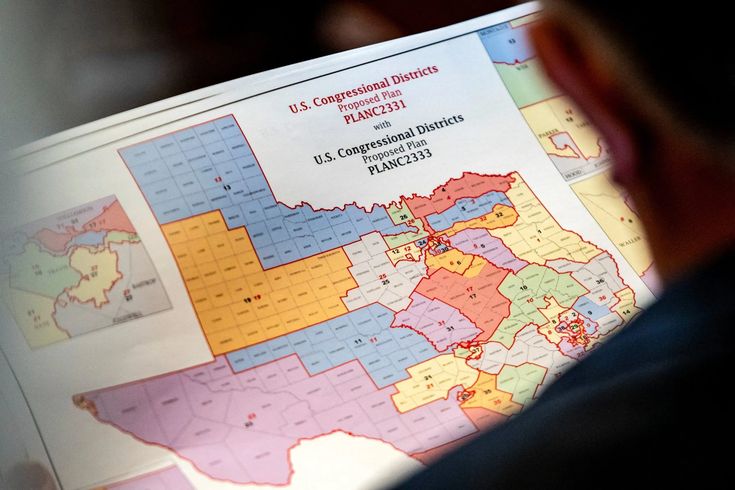

12. U.S. Supreme Court Approval of Texas’ New Congressional Map

The U.S. Supreme Court’s decision to uphold Texas’ redrawn congressional map marks a major development in American electoral politics. The ruling reinforces state authority over redistricting and weakens arguments of racial gerrymandering brought forward by civil rights groups.

Republicans are expected to benefit significantly from the new boundaries, reshaping political strategies for the 2026 midterms. Democrats warn that minority representation could be severely impacted.

The ruling also sets a precedent that could influence other states undergoing redistricting battles. As legal challenges surge nationwide, the political climate surrounding voting rights, representation, and electoral fairness is becoming increasingly polarized.

Campaign spending, polling forecasts, and voter outreach strategies will now realign according to newly drawn districts.

13. Mass Killings in El Fasher, Sudan: A Rapidly Escalating Humanitarian Crisis

El Fasher in Sudan’s Darfur region is experiencing alarming levels of violence, with mass killings reported by international observers. Ethnic tensions, militia warfare, and power struggles continue to fuel atrocities.

Millions remain displaced, facing starvation, lack of medical aid, and inadequate shelter. Humanitarian organizations are struggling to gain access due to security threats and logistical constraints. Neighboring regions like Chad and South Sudan are facing refugee inflows that overwhelm local resources.

The conflict risks evolving into a regional crisis if left unchecked. International pressure for sanctions, peacekeeping missions, and diplomatic intervention is rising, but coordination remains weak.

14. Global Market Volatility Ahead of U.S. PCE Inflation Report

Global financial markets are on edge as investors await the U.S. PCE inflation data—one of the Fed’s most important policy indicators. Even slight deviations from forecasts could result in significant market turbulence.

Sectors sensitive to interest rates—banking, real estate, and high-growth tech—are especially vulnerable. Rising options trading volumes indicate traders are hedging against large swings.

The PCE report could either reinforce expectations of a December rate cut or eliminate them entirely, depending on the data. Global markets, including emerging economies, will be deeply affected by the outcome.

15. Canada’s Additional Ukraine Aid & EU Funding Disputes

Canada’s announcement of further financial aid for Ukraine reinforces global support for Kyiv amid internal EU disagreements over long-term funding structures. European leaders remain divided over utilizing frozen Russian assets to finance loans for Ukraine’s reconstruction and defense.

Canada’s bilateral assistance reflects growing recognition that Ukraine needs stable, predictable funding—not fragmented, temporary packages. Nations are coordinating through NATO and multilateral channels to cover immediate needs like ammunition, military equipment, and humanitarian support.

The final funding architecture will depend on whether the EU can resolve legal obstacles and political divisions. Until then, Ukraine remains heavily dependent on ad hoc international assistance to sustain its war and reconstruction efforts.